The Need for DFA's AI Monitor TM

-

Replacing human agents with AI engages model risk management regulations

-

Model Risk Management requires a 2nd Line of Defense, independent oversight

-

Looking for rare events in a high speed, automated process is beyond human capabilities

-

We need an independent AI trained to monitor front line AI

Benefits of GenAI- Based Monitoring

Scalability

DFA’s AI Monitor™ can assess a larger sample of AI-generated communications than human reviewers, which enhances detection rates

Consistency

DFA’s AI Monitor™ remains unaffected by fatigue, bias, or shifts in attention over time. Metrics compare human and AI agents.

Refinement

Through feedback from human reviewers, the DFA’s AI Monitor™ will be steadily refined or customized to specific client domains.

Rapid Response

AI models can instantly flag potential violations, allowing human compliance officers to intervene when necessary.

Regulatory Transparency

Using DFA’s AI Monitor™ for compliance monitoring ensures a structured, quantifiable approach to regulatory and ethical compliance.

Real-time Audit Report Generation

All of the key outputs from DFA’s AI Monitor™ Dashboard

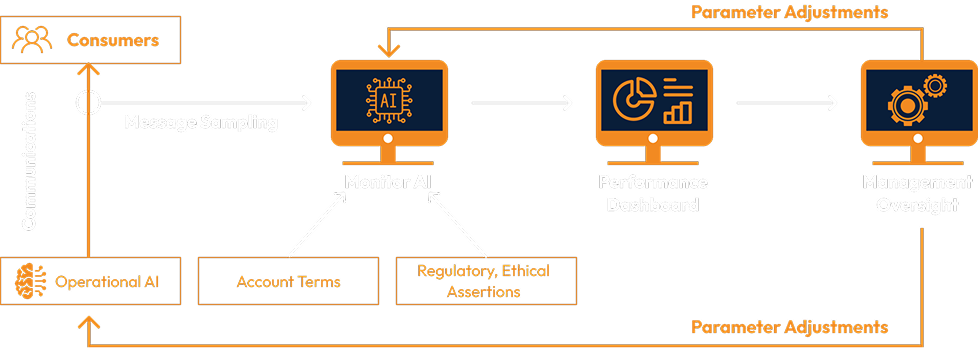

AI Monitor System View

Example Assertions

AI Monitor System View

AI Monitor Comparing Agents

- Applicable to both human and AI agents for comprehensive compliance monitoring.

- Establishes a compliance baseline by comparing human and AI agent behavior

-

Efficiently scans human-human

communications to detect compliance risks. -

Tracks AI agent behavior across version

changes using unique Agent IDs.

About us

Deep Future Analytics (DFA) is the result of 30 years of research and experience in credit risk analytics, in all its many aspects

Joseph Breeden

PhD, Founder, CEO and Chief ScientistAbout us

Deep Future Analytics (DFA) is the result of 30 years of research and experience in credit risk analytics, in all its many aspects

Our Founder and CEO

- PhD Physicist – Chaos Theory

- 30+ years of experience in the industry. Global expertise.

- Leading expert in the industry. 6 books, 90+ academic research articles.

- Inventor of vintage modeling for stress testing, ML cash flow modeling, multi-horizon survival models

- Holds 8 patents in lending and AI analytics

- President – Model Risk Managers International Association

- Editorial Board of AI and Ethics Journal

- Author of key papers in ML fairness, quantifying ethical impacts of AI policies, and the evolution of AI goals

Board Members

-

David Hilger,Allied Solutions

David Hilger,Allied Solutions -

John DenisonAllied Solutions

John DenisonAllied Solutions -

Anju Patwardhan

Anju Patwardhan -

Joseph BreedenCEO

Joseph BreedenCEO